Uniswap Price Jumps 62% As Arthur Hayes Buys $244K UNI

Join Our Telegram channel to stay up to date on breaking news coverage

The Uniswap price soared 62% in the past week to trade at $8.40 as of 2:55 a.m. EST on trading volume that plunged 40% to $2 billion.

This comes as BitMEX co-founder Arthur Hayes makes his first move into Decentralized Finance (DeFi) by acquiring 28,670 Uniswap tokens valued at around $244k.

After 3 years, Arthur Hayes(@CryptoHayes) is back into $UNI— buying 28,670 $UNI($244K).https://t.co/loeYKUb9rN pic.twitter.com/b88wHGlyPz

— Lookonchain (@lookonchain) November 11, 2025

UNI has lost 1% in the past 24 hours, but Hayes’ move comes after a strong rally prompted by excitement around UNIfication, a plan aims to activate protocol fees, initiate a UNI-burning mechanism, and provide incentives across the ecosystem.

Hayes has a reputation as a contrarian in his investments and frequently gets involved in assets he believes are underpriced or are just entering a new narrative cycle.

CryptoQuant CEO Says Uniswap Has ‘Parabolic’ Potential

Following Hayes’ purchase, Ki Young Ju, CEO of CryptoQuant, predicted significant price growth for the UNI token if Uniswap activates its fee-switch mechanism.

Young Ju shared on social media that, with Uniswap’s trading volume reaching $1 trillion since the start of the year, the potential annual burn could reach $500 million, assuming current volume levels persist.

Uniswap could go parabolic if the fee switch is activated.

Even just counting v2 and v3, with $1T in YTD volume, that’s about $500M in annual burns if volume holds.

Exchanges hold $830M, so even with unlocks, a supply shock seems inevitable. Correct me if I’m wrong. https://t.co/39QjJsw9uQ pic.twitter.com/3FQzAmuOP3

— Ki Young Ju (@ki_young_ju) November 11, 2025

He said this development could lead to a parabolic increase in UNI’s price.

Uniswap Price On A Parabolic Rally

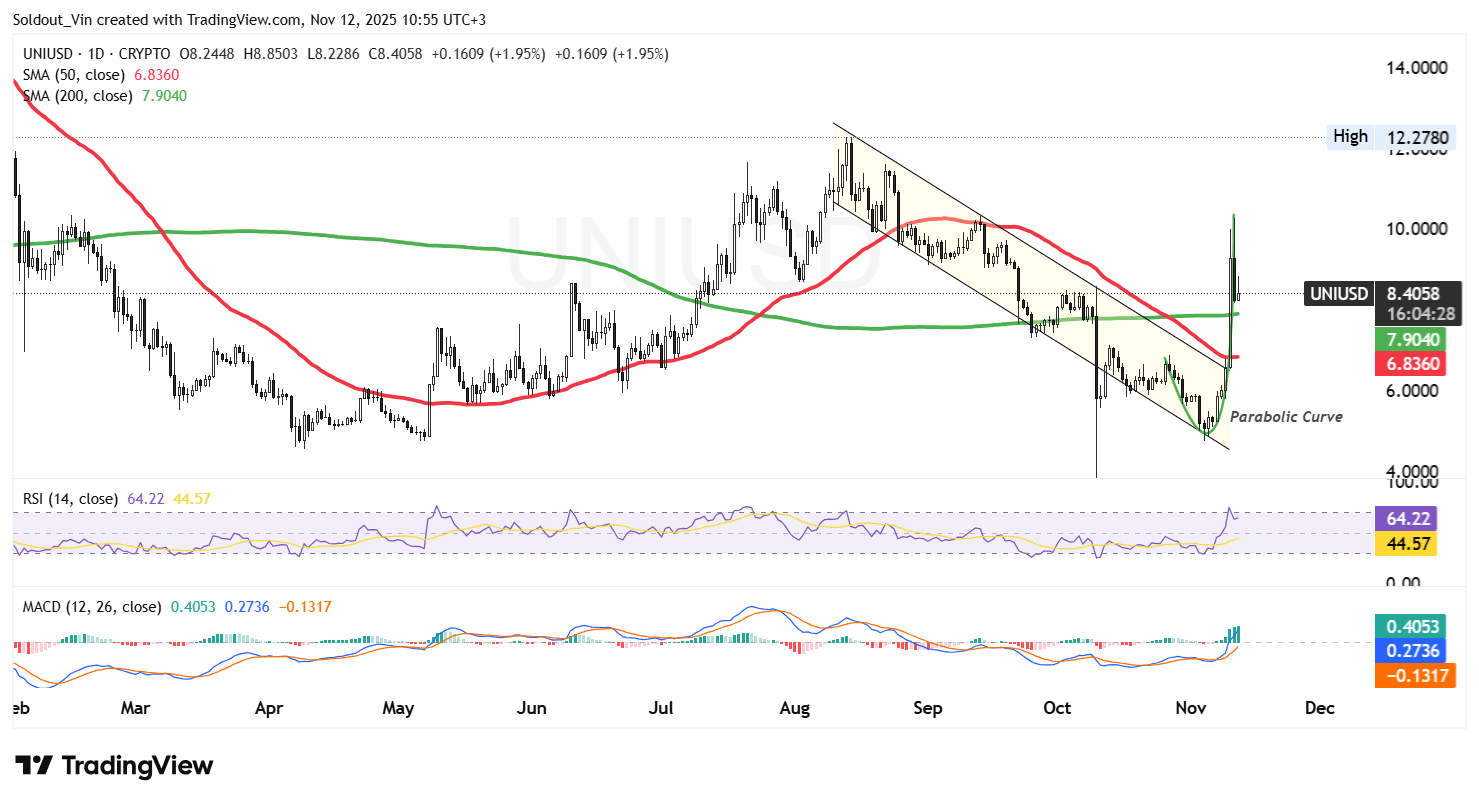

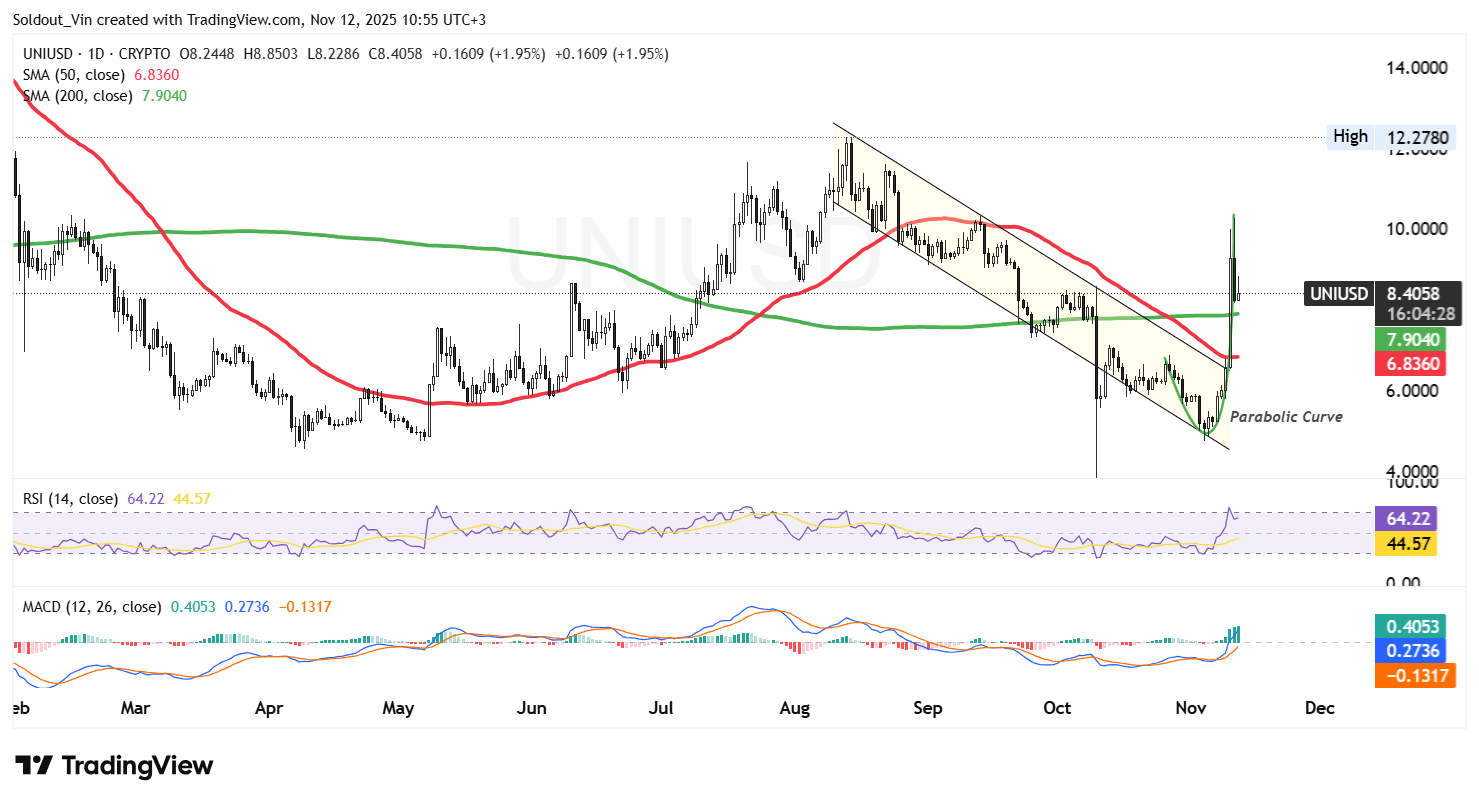

After forming a double bottom pattern between April and May 2025, the $4.80 support level allowed the UNI price bulls to push the price up, supported by the golden cross around $7.9.

However, the resistance around $12.3 allowed the bears to take control of the Uniswap price, leading the token into a corrective phase within a falling channel.

This bearish pressure, however, was reversed by the bulls at the $4.90 level, causing UNI to rally parabolically to the $10.3 resistance on the 1-day timeframe before retracing to the current price around $8.40.

Meanwhile, the token has turned positive and is in a bullish rally, with the price of UNI surging above both the 50-day Simple Moving Average (SMA) ($6.83) and the 200-day SMA ($7.90).

The Relative Strength Index (RSI) also shows signs of a sustained rally, as it moves above the 50-midline level and towards the overbought zone, currently at 64.

Moreover, the Moving Average Convergence Divergence (MACD) has cemented the rally, as the blue MACD line has crossed above the orange signal, forming a bullish crossover. The green bars on the histogram also show positive momentum, climbing above the zero line.

UNI Price Prediction

Based on the current technical setup, the UNI price appears poised for continued bullish momentum following its breakout from the falling channel pattern and the formation of a strong parabolic curve.

The price of Uniswap has surged above both the 50-day and 200-day SMAs, signaling a potential trend reversal into a sustained uptrend. If momentum continues, UNI could target the next resistance around $10.00, with a possible extension toward $12.30, the recent swing high.

However, minor pullbacks to retest support levels near $7.90 or $6.80 are possible before another rally.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage