Swap Crypto & Bridge Crypto in 2025: Symbiosis, Uniswap v4, 4-Swap

What are crypto swaps, crypto bridges and conversion tools?

We are well past the halfway mark of 2025, and crypto swaps are everywhere. But is that just hype, or does the data back it up? And what exactly is a crypto swap, and how does it differ from bridging or exchanging?

In Q2 2025, decentralized exchanges (DEXs) saw a huge 25.3% jump in spot trading volume, hitting over $876 billion. Around the same time, centralized exchanges (CEXs) dropped almost 28%, ending the quarter at $3.9 trillion.

A clear trend can be uncovered here: More people are choosing direct crypto swaps over the traditional “sell to fiat, then buy again” method.

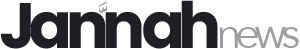

A crypto swap is a direct, wallet-to-wallet exchange of one digital asset for another — no fiat currency, no order books and no third-party custody. Instead of selling your Bitcoin (BTC) for dollars and then buying Ether (ETH), you swap BTC for ETH in a single step.

When people talk about converting crypto, they often mean selling into fiat or using a platform’s internal “conversion” tool, which may add hidden fees, delays or intermediaries.

Swapping bypasses these issues, especially when paired with cross-chain swap or bridge crypto solutions for moving assets between different blockchains.

Benefits of swapping vs. traditional trading

Here’s why many users prefer a decentralized swap over trading through an exchange.

-

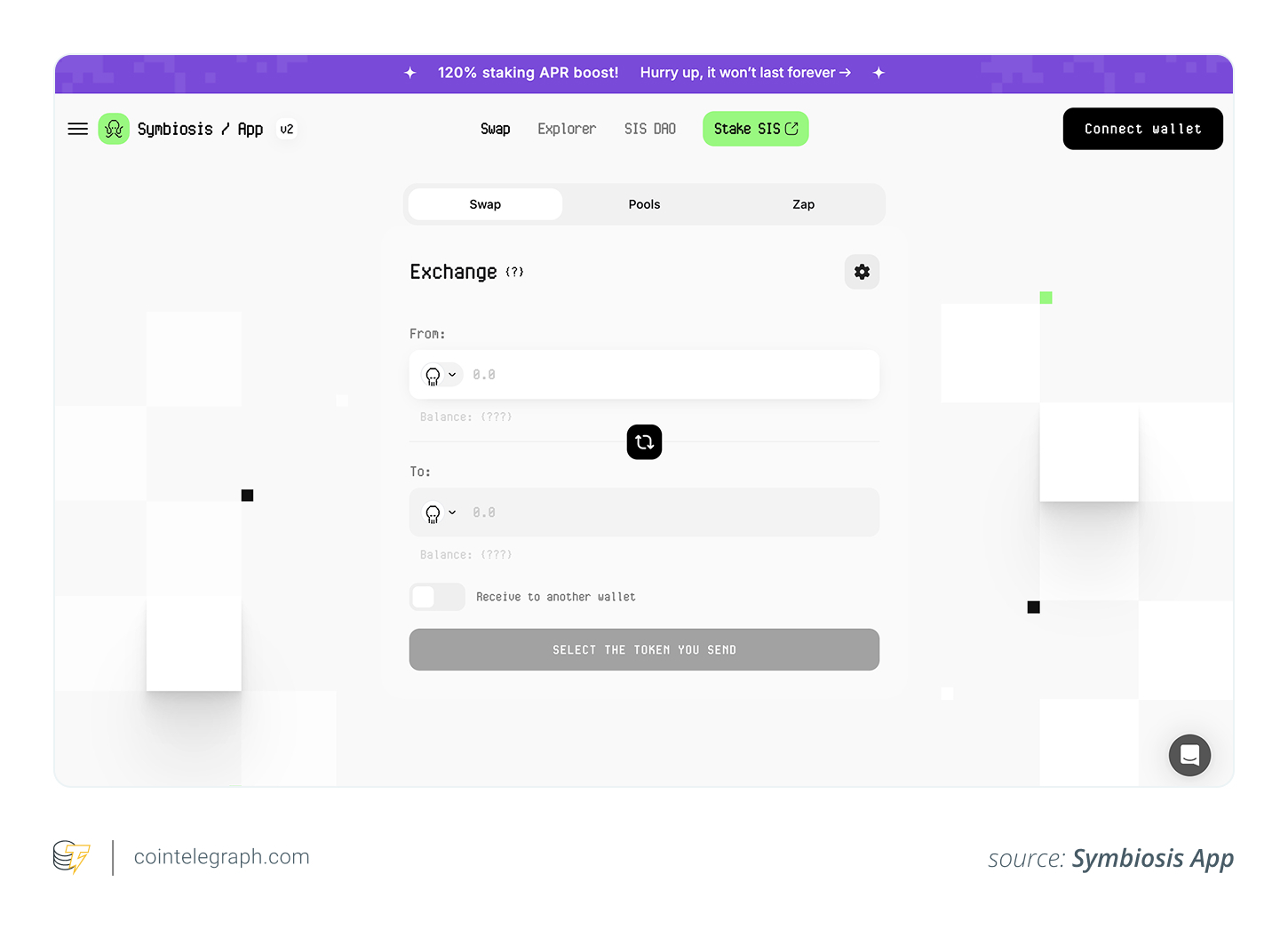

Lower fees: Swaps often avoid high trading fees and markups. You will usually only pay small network or smart contract gas costs.

-

Better liquidity access: It avoids thin order books and price slippage. Automated market maker-based swaps tap into liquidity pools, making transactions smoother.

-

Non-custodial control: You keep your own private keys. No Know Your Customer (KYC) process, no trusting a centralized exchange to hold your funds.

-

Faster transactions: With most onchain swaps, the process is almost instant. You don’t have to deal with multi-step conversions or wait for fiat settlements.

Risks of swapping cryptocurrencies

While swapping is quick and cost-effective, there are still risks to be aware of.

-

Smart contract vulnerabilities: If the DEX or bridge uses faulty code, funds could be at risk.

-

Slippage on large trades: Bigger swaps can still move the market, especially on low-liquidity pairs.

-

Limited advanced features: Swaps aren’t built for complex trading strategies.

That’s why the best cross-chain bridges of 2025 and swap platforms focus on security audits, deep liquidity pools and protective measures like front-running prevention.

Ultimately, for most users, the combination of speed, low cost and keeping custody makes swapping crypto (especially across chains) more appealing than traditional trading.

How are crypto swaps changing in 2025?

Swaps have come a long way. The best platforms now scan across chains, bridges and rollups to give you better rates with less risk.

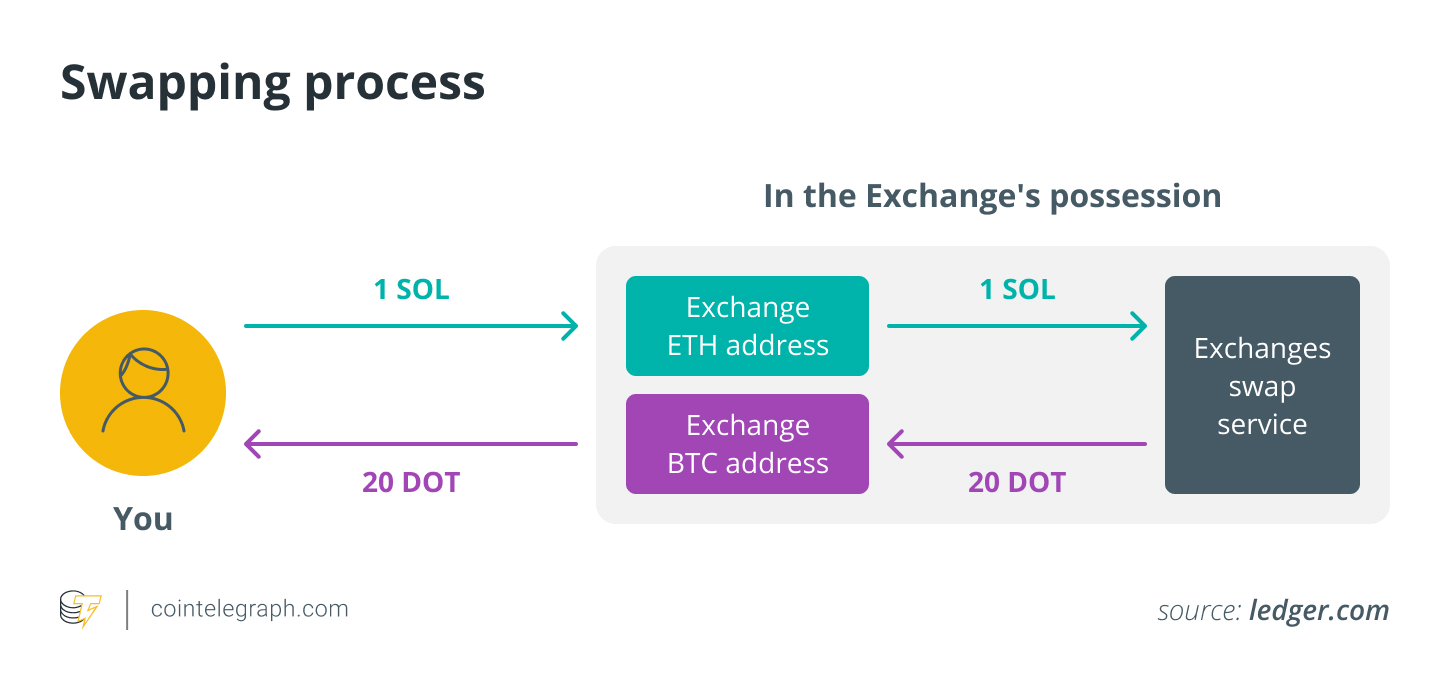

Symbiosis.finance, for example, taps into liquidity from layer 1s, layer-2 bridges and both Ethereum Virtual Machine (EVM) and non-EVM networks to tighten rates and cut risks.

This means users can perform cross-chain swaps without ever touching a separate bridge interface.

One of the most notable upgrades is that Symbiosis built its own blockchain (the SIS chain) to manage and swap bridge logic internally. This has two big benefits:

-

Consistent, predictable fees instead of fluctuating bridge charges

-

Faster, more reliable execution for cross-chain transactions.

Security stays decentralized. The network runs on a delegated proof-of-stake (PoS) model, where tokenholders can act as validators or delegate to others. This spreads out responsibility, reduces the risk of centralized control and aligns incentives for honest participation.

This architecture eliminates the need for traditional pooled-asset bridges, a type of decentralized bridge that has been a common target for exploits in recent years.

Also, by integrating chain bridging protocols directly into its own blockchain, Symbiosis removes several points of failure while keeping the user experience fast and straightforward.

In short, the best cross-chain bridges of 2025 have become about making swaps as easy as a single click, while quietly solving the complex cross-chain interoperability and security challenges in the background.

Did you know? Symbiosis operates a peer-to-peer Relayers Network that runs offchain alongside its smart contracts. This network uses multi‑party computation (MPC) and threshold signature schemes (TSS) to validate cross-chain operations; relayers stake SIS tokens and earn rewards.

Other modern options for cross-chain swaps

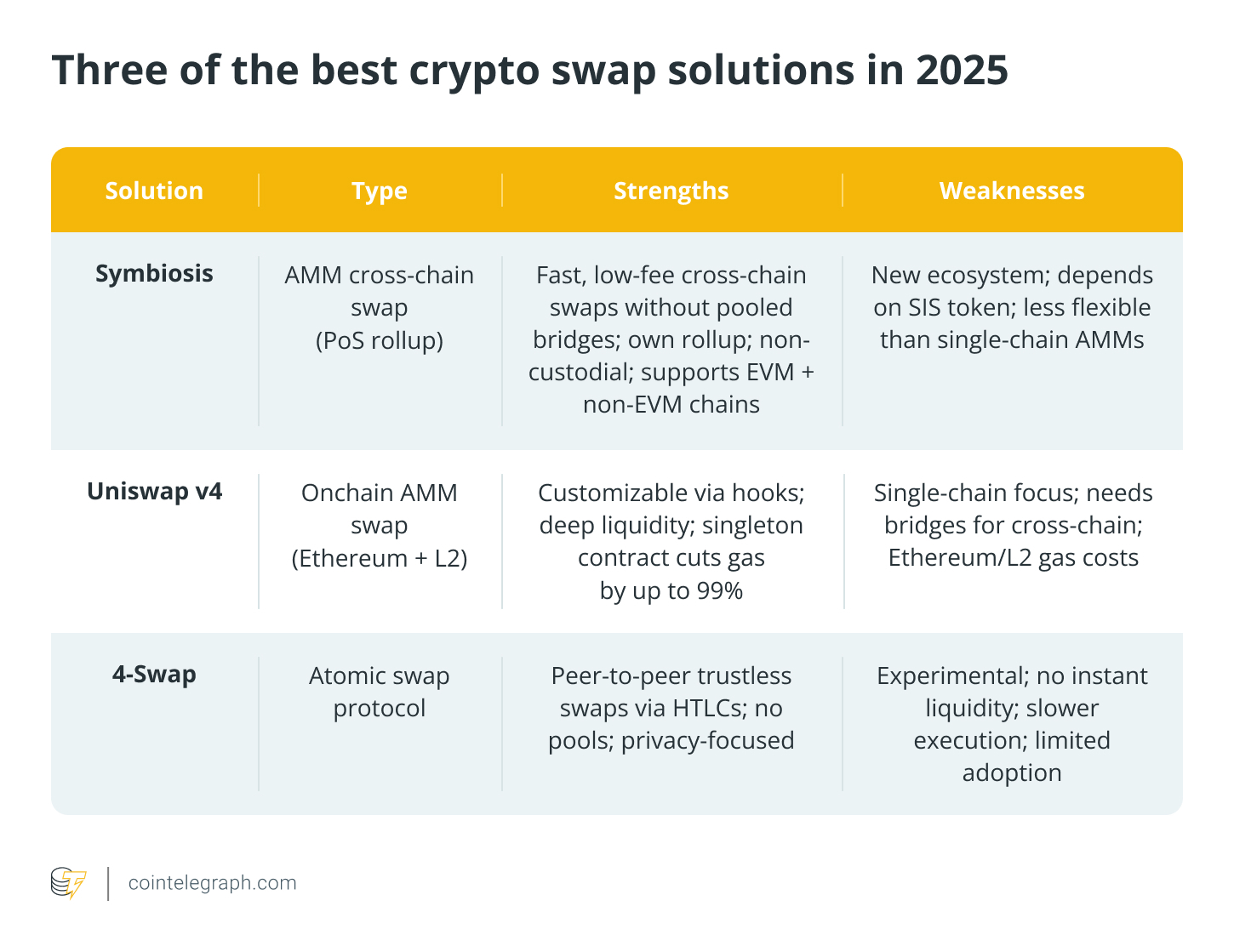

While platforms like Symbiosis have set a high standard for swapping and bridging crypto in 2025, different providers take very different technical paths to achieve the same goal: letting users move assets between blockchains quickly, securely and cost-effectively.

Uniswap v4: Single-chain AMM with extreme efficiency

Uniswap v4 focuses on in-chain swaps rather than cross-chain interoperability. Its architecture is built to deliver deep liquidity and ultra-low gas fees within Ethereum and supported layer 2s, but it doesn’t natively bridge crypto between chains.

Its headline upgrade, the hooks framework, allows developers to insert custom logic at specific points in a swap’s lifecycle, things like:

-

Adjusting fees in real time based on market conditions

-

Adding new order types, like TWAP or limit orders

-

Integrating onchain oracles for accurate pricing and slippage control.

Under the hood, Uniswap v4 uses a singleton contract architecture and flash accounting, cutting gas use by up to 99% compared to earlier versions. This makes it ideal for users who prioritize low-fee swaps and custom trading logic within a single ecosystem.

Did you know? Uniswap v4 introduces hook fees (custom code that runs before swaps), allowing developers to impose bespoke charges such as withdrawal penalties or performance-based rewards.

4-Swap: Peer-to-peer atomic swap protocol

4-Swap takes a completely different route. Instead of automated market maker (AMM) liquidity pools or rollups, it uses hashed time-locked contracts (HTLCs) to enable direct onchain swaps between two parties across different blockchains — no pooled liquidity, no bridging contracts.

Its “grief-free” mechanism fixes a long-standing issue in older atomic swap designs, where one party could stall the process to waste the other’s time or gas. Here, the transaction flow is structured so that stalling offers no advantage.

4-Swap’s main appeal is maximum trustlessness and privacy, but it comes with trade-offs: Swaps depend on finding a matching counterparty, and prices are negotiated rather than set by an AMM.

4-Swap is better suited to niche markets or technically advanced users who are comfortable with slower execution.

Did you know? 4‑Swap is the first atomic swap protocol that cleverly combines the griefing penalty and the principal amount into a single transaction per blockchain, which dramatically reduces the total onchain steps to just four (delivering faster execution without needing any new Bitcoin opcodes).

These examples show just how varied the technology behind cross-chain swaps can be, ranging from high-speed AMM aggregators to manual atomic swap protocols and beyond.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.