Google Becomes Largest Shareholder in TeraWulf

Tech giant Google has become the largest shareholder of TeraWulf, holding 14% of shares, after receiving more stock in exchange for increasing its backstop in the lease deal between the Bitcoin miner and AI infrastructure provider Fluidstack.

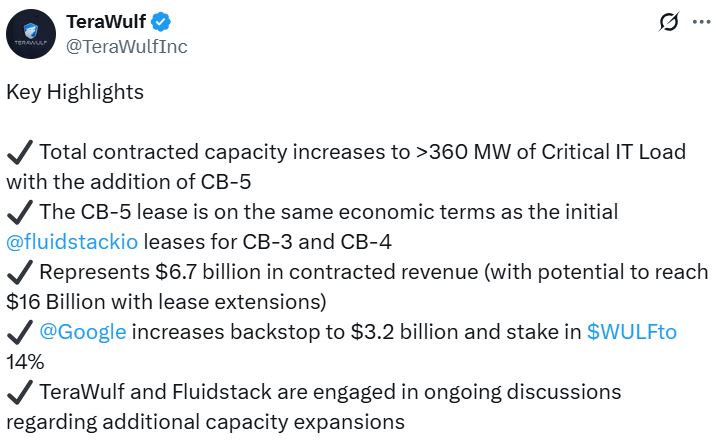

TeraWulf disclosed in a shareholder call on Thursday that it inked a 10-year colocation lease agreement with Fluidstack. Google is supporting the lease obligations through a financial guarantee known as a backstop and receiving warrants to purchase shares in return.

Speaking to Cointelegraph, Kerri Langlais, the chief strategy officer of TeraWulf, said Google’s backstop in the agreement has now increased to $3.2 billion total in return for warrants to purchase over 73 million shares in TeraWulf, representing a 14% stake in the company.

Langlais added that Google’s new equity makes it TeraWulf’s largest shareholder, providing a “powerful validation from one of the world’s leading technology companies,” and highlighting “the strength of our zero-carbon infrastructure and the scale of the opportunity ahead.”

Google’s backstop safeguards the deal

TerraWulf said in a statement on Monday that Fluidstack exercised an option in the deal to expand at TeraWulf’s Lake Mariner data center campus in New York with a new purpose-built data center, due to start operation in the second half of 2026.

Langlais told Cointelegraph the financial backstop supports Fluidstack’s long-term lease commitments at Lake Mariner, and if the AI company could not meet its financial obligations, Google would step in with the $3.2 billion.

“This is not a guarantee of TeraWulf’s corporate debt, nor do we have access to those funds,” she said.

“The backstop is tied exclusively to contracted AI and high-powered computing lease revenues and is unrelated to our Bitcoin mining operations.”

TeraWulf plans to maintain Bitcoin mining platform

A growing number of Bitcoin (BTC) miners have been diversifying income streams by shifting their energy capacity toward AI and high-power computing (HPC) hosting services after the April 2024 halving cut mining rewards to 3.125 Bitcoin, hurting overall profitability.

Langlais said in the future, TeraWulf plans to maintain, but not expand, its Bitcoin mining platform at Lake Mariner, with a focus on “execution: building, hosting, and delivering for our partners and our shareholders.”

“In the near term, mining generates cash flow and provides a valuable resource to the electrical grid, as its flexible load can be rapidly adjusted to support stability and reliability.”

However, over the medium to long term, the firm sees “greater value in transitioning those megawatts” to AI and HPC workloads, where long-term contracted revenues with blue-chip partners such as Fluidstack and Google “will drive growth and value creation.”

In an August 2024 report, asset manager VanEck estimated that if publicly traded Bitcoin mining companies shifted 20% of their energy capacity to AI and HPC by 2027, they could increase additional yearly profits by $13.9 billion over 13 years.

TeraWulf has projected its agreement with Fluidstack to generate $6.7 billion in revenue, potentially reaching $16 billion through lease extensions.

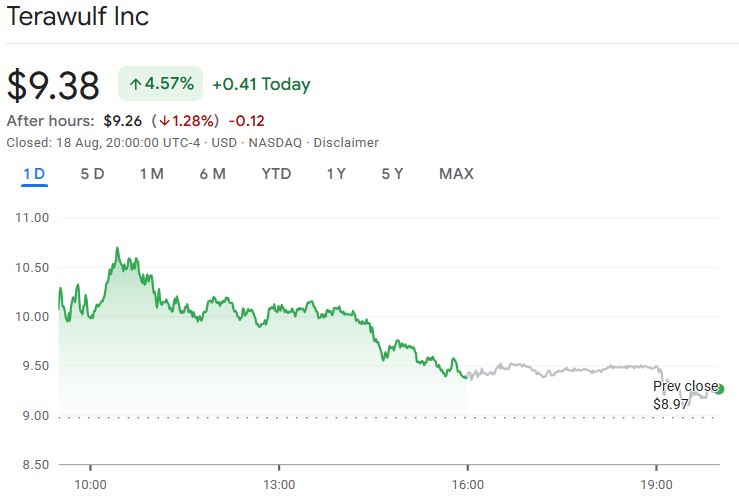

TeraWulf stock price on the rise

In the Monday trading session, TeraWulf’s stock (WULF) staged a rally to $10.57, representing a 17% increase over the previous close of $8.97.

Related: Bitcoin miner BitFuFu mines 445 BTC for its biggest production month

However, by the end of the session, the miners’ share price had settled at $9.38 and lost a further 1.28% after the bell.

Since TeraWulf first announced its agreement with Fluidstack on Thursday, its stock price has registered a more than 72% gain in the last five days.

Magazine: Coinbase calls for ‘full-scale’ alt season, Ether eyes $6K: Hodler’s Digest, Aug. 10 – 16