What Happened In Crypto Today

Today in crypto, Qubic community votes to target Dogecoin after 51% attack on Monero, Japan’s FSA is set to approve JPYC as the country’s first yen-pegged stablecoin. Meanwhile, Galaxy’s Mike Novogratz warns that a $1 million Bitcoin price in 2026 would not be a positive sign for the economy.

Qubic community votes to target Dogecoin after 51% attack on Monero

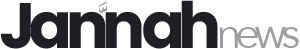

The community behind Qubic, an AI-focused blockchain responsible for Monday’s 51% attack on the Monero (XMR) privacy network, voted to target Dogecoin next.

Qubic founder Sergey Ivancheglo, who uses the online pseudonym Come-from-Beyond, gave the community several choices for the next target, including DOGE, Kaspa (KAS), Zcash (ZEC), and any other blockchain named by a member.

DOGE received over 300 votes from the Qubic community by the time the vote concluded, more than all other choices combined.

Qubic’s successful 51% attack on Monero and the fact that the community is now looking to target other proof-of-work blockchains could spell trouble for these blockchain-based monetary networks.

Japan to approve first yen-backed stablecoins this fall

Japan’s Financial Services Agency (FSA) is preparing to approve the issuance of yen-denominated stablecoins as early as this fall, marking the first time the country will allow a domestic fiat-pegged digital currency.

Tokyo-based fintech firm JPYC will register as a money transfer business within the month and will lead the rollout, Japanese news outlet The Nihon Keizai Shimbun reported on Sunday.

JPYC is designed to maintain a fixed value of 1 JPY = 1 yen, backed by highly liquid assets such as bank deposits and Japanese government bonds. After purchase applications from individuals or corporations, the tokens are issued via bank transfer to digital wallets.

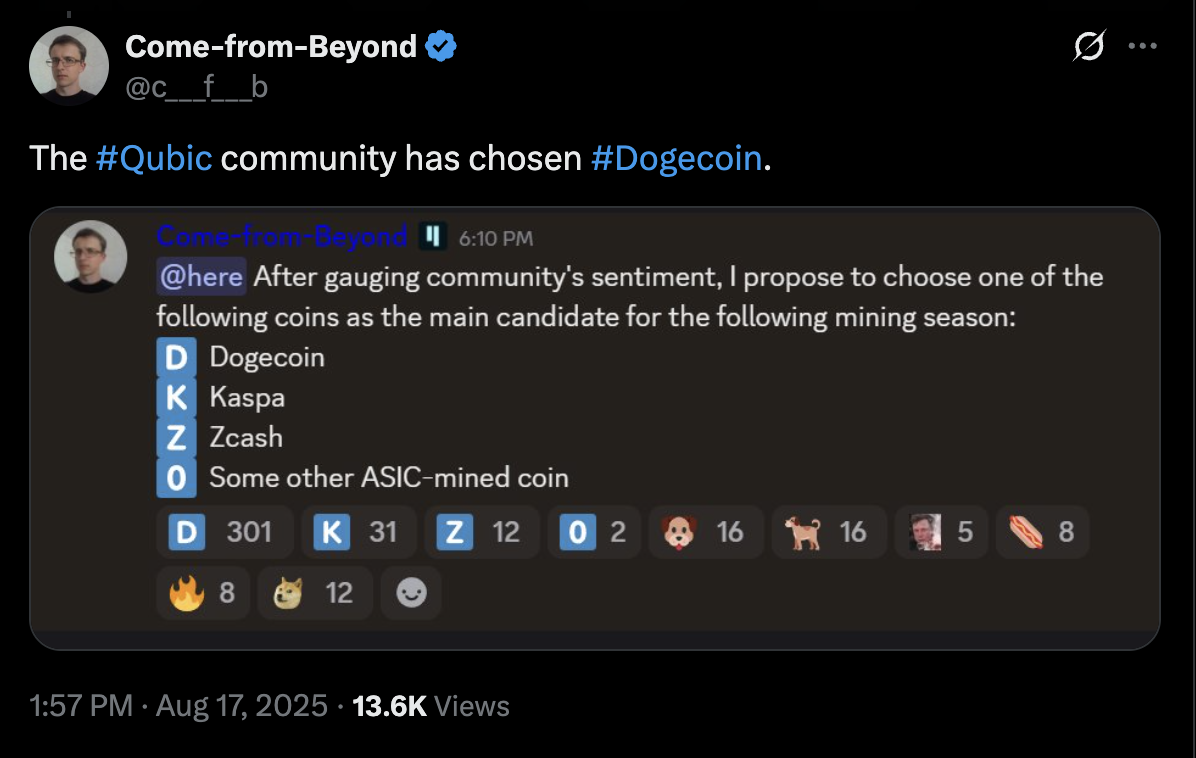

The approval comes as the global stablecoin market, dominated by dollar-pegged assets like USDt (USDT) and Circle’s USDC (USDC), has expanded to more than $286 billion. While US dollar stablecoins already have a foothold in Japan, this will be the country’s first yen-based offering.

$1M Bitcoin in 2026 would signal trouble: Galaxy’s Mike Novogratz

Galaxy Digital CEO Mike Novogratz says a million-dollar Bitcoin next year wouldn’t be a victory but rather a sign that the US economy is in serious trouble.

“People who cheer for the million-dollar Bitcoin price next year, I was like, Guys, it only gets there if we’re in such a shitty place domestically,” Novogratz told Natalie Brunell on the Coin Stories podcast on Wednesday.

“I’d rather have a lower Bitcoin price in a more stable United States than the opposite,” Novogratz said, explaining that severe currency devaluations often come at the expense of civil society.

When a national currency falls, investors often seek alternative safe havens to protect their wealth, and Bitcoin is frequently referred to as digital gold.