What Happened In Crypto Today

Today in crypto, Bo Hines, director of White House Crypto Council steps down and Trump-linked World Liberty Financial is weighing a $1.5 billion Nasdaq-listed treasury company to hold WLFI tokens. Meanwhile, a significant amount of Ether shorts got liquidated.

Bo Hines announces he is stepping down from the White House Crypto Council

Bo Hines, the executive director of the White House Crypto Council, an advisory group to US president Donald Trump, announced he is stepping down as head of the group on Saturday.

The departing crypto advisor said he is rejoining the private sector, but will continue to advocate for digital assets. Hines wrote in an X post:

“Serving in President Trump’s administration and working alongside our brilliant AI & Crypto Czar, David Sacks, as Executive Director of the White House Crypto Council, has been the honor of a lifetime. Together, we have positioned America as the crypto capital of the world.”

The crypto council has garnered praise from supporters, who say the group helped establish a guiding regulatory framework for digital assets in the US, and criticism from those who say the group has ignored key pieces of Bitcoin legislation.

World Liberty Financial weighs $1.5B public company to hold WLFI tokens

World Liberty Financial, the Trump family-backed crypto venture, is exploring the creation of a publicly traded company to hold its WLFI tokens, with a fundraising target of roughly $1.5 billion.

The structure of the deal is still being finalized, but major investors in technology and crypto have been approached, and discussions are said to be progressing quickly, according to a Friday report from Bloomberg.

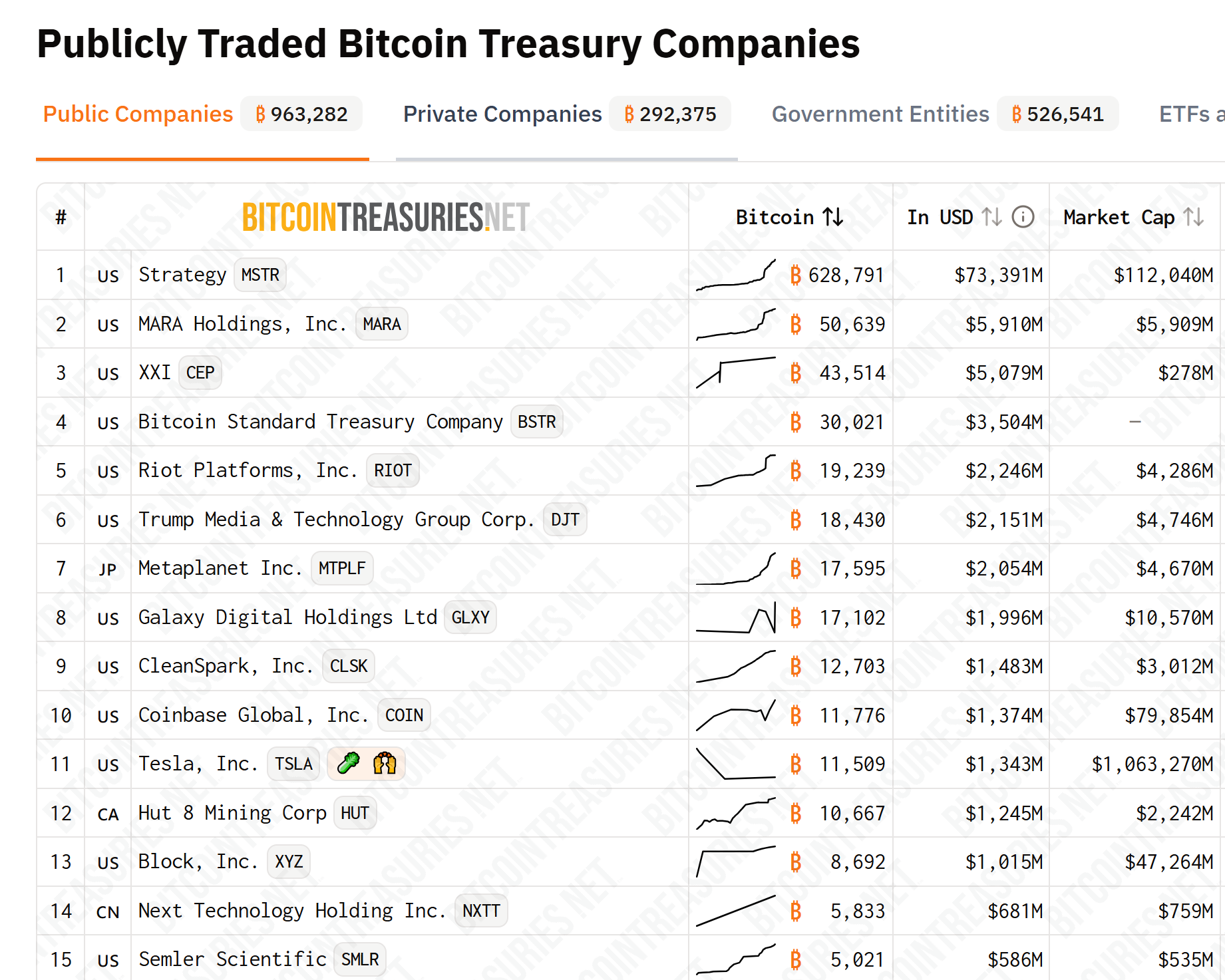

The move would place World Liberty among a growing wave of digital-asset treasury companies, which are publicly traded firms holding crypto reserves. These companies have raised an estimated $79 billion in 2025 for Bitcoin purchases alone, per the report.

World Liberty, whose website names Donald Trump as “co-founder emeritus,” launched last year with plans for a crypto-lending app and currently offers USD1, a dollar-backed stablecoin.

$105M Ether shorts got ‘smoked,’ Eric Trump throws shade at bears

Ether saw the largest short position wipeout of the day across all crypto assets on Friday as its price surpassed $4,000, with some analysts saying it could be setting the stage for a short squeeze.

The rally led to Eric Trump, son of US President Donald Trump, taking a jab at bearish traders.

“It puts a smile on my face to see ETH shorts get smoked today. Stop betting against BTC and ETH – you will be run over,” Trump said in an X post on Friday.

On Friday, approximately $105 million in Ether short positions were liquidated, representing about 53% of the total $199.61 million in shorts liquidated from the entire crypto market, as Ether surpassed the $4,000 price level for the first time since December 2024, according to CoinGlass.