Ethereum is trading above the $3,850 mark after staging a swift rebound from its recent correction, signaling renewed bullish momentum. The recovery has been fueled by strong buying interest, with market sentiment improving as price action tilts in favor of the bulls. Many analysts are now calling for a breakout above the $4,000 level in the coming sessions, a move that could set the stage for multi-month highs.

Institutional adoption continues to strengthen Ethereum’s position, as more companies and funds integrate ETH into their portfolios. Meanwhile, network activity remains robust, with growing engagement in decentralized finance (DeFi), NFTs, and tokenized assets reinforcing the asset’s fundamental value.

Adding to the bullish narrative, on-chain analytics platform Santiment reports that whales have accumulated massive amounts of Ethereum in the past 30 days. This sustained accumulation trend suggests that big players are positioning for a potential long-term rally, viewing the current levels as an attractive entry point.

Whales Signal Confidence as Ethereum Eyes $4K Breakout

According to analyst Ali Martinez, on-chain data shows that whales have purchased more than 1.80 million Ethereum in the past month. This large-scale accumulation supports the view that big players are positioning for long-term gains, despite ongoing market volatility. Such buying activity often precedes major moves, reinforcing bullish sentiment across the market.

Analysts are increasingly calling for Ethereum to break above the $4,000 mark in the near term, with some projecting a test of all-time highs in the coming weeks. A sustained breakout could trigger strong momentum, but the path higher may not be without turbulence. Many expect a volatile consolidation phase below ATH levels before any decisive move toward uncharted territory.

Adding to Ethereum’s bullish outlook is the rising trend of corporate ETH treasury strategies. Public companies such as Sharplink Gaming and Fundamental Global have recently integrated Ethereum into their balance sheets, marking a shift in institutional approaches to digital asset exposure. These moves highlight growing confidence in Ethereum’s long-term role as a settlement layer for decentralized finance, stablecoins, and tokenized assets.

With both whales and institutions showing commitment, market watchers believe the coming months could mark the beginning of the long-awaited altseason.

Ethereum Price Analysis: Bulls Target $4,000 Breakout

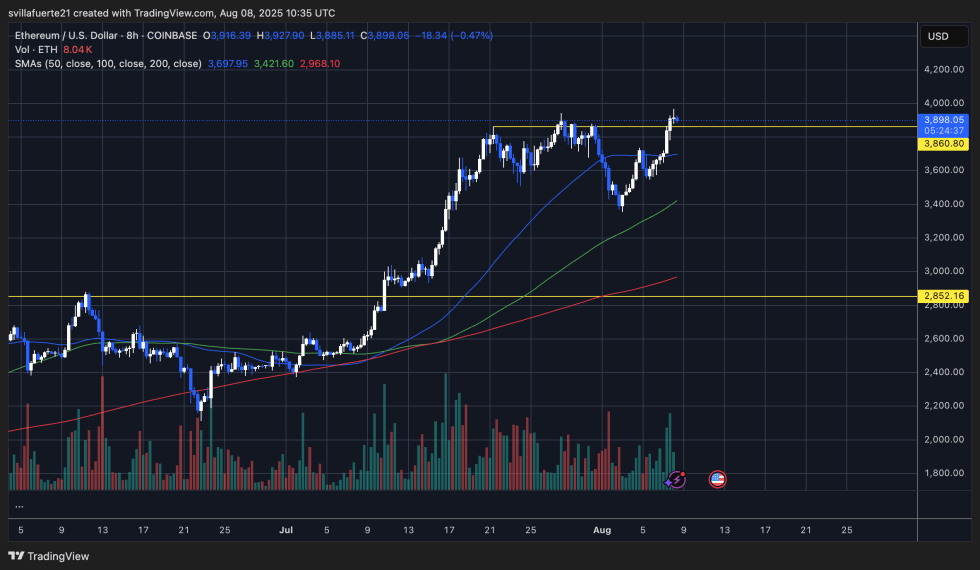

Ethereum (ETH) is trading around $3,898 after an impressive recovery from its recent correction. The chart shows strong bullish momentum, with ETH breaking above the key resistance level at $3,860, now acting as short-term support. This breakout suggests increased buyer confidence, as bulls push for a move toward the psychological $4,000 mark.

The 50-day simple moving average (SMA) is sloping upward and sits well above the 100-day and 200-day SMAs, reinforcing the bullish structure. Price action remains comfortably above all three major SMAs, a sign that the trend is still intact. Volume spikes on recent green candles also indicate growing market participation on the buy side.

If ETH manages to close and hold above $3,900 in the coming sessions, momentum could drive it to test the $4,000–$4,050 zone, a key resistance that may trigger profit-taking before any further rally. On the downside, $3,860 is now the first line of defense for bulls, followed by the $3,700 area aligned with the 100-day SMA.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.