BlackRock Bitcoin ETF Records Largest Outflow Since May

BlackRock’s US-listed Bitcoin fund recorded its biggest outflow since May as Bitcoin dipped over the weekend and recovered slightly on Monday.

BlackRock’s iShares Bitcoin Trust (IBIT) saw an outflow of $292.5 million on Monday, its largest in two months. There was also a minor outflow on Friday, which ended a 37-day inflow streak.

The reversals come as Bitcoin (BTC) fell further from its July 14 all-time high over the weekend, retreating 8.5% to bottom out at $112,300 on Sunday before recovering to $115,000 in late trading on Monday.

BlackRock’s latest outflow is a blip compared with a monumental net inflow of $5.2 billion in July, which accounted for 9% of the net inflows the ETF has enjoyed since it launched in January 2024.

Related: BlackRock iShares Bitcoin ETF surpasses 700K Bitcoin

Spot Bitcoin ETFs cooling off

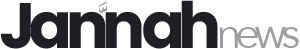

It is now the third trading day that US-listed spot Bitcoin ETFs have sold off in aggregate.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) outflowed around $40 million, and the Grayscale Bitcoin Trust (GBTC) shed $10 million, while the rest of the US-based products saw zero flows on Monday aside from Bitwise (BITB), which saw an inflow of $18.7 million.

Outflows appeared to have slowed as the asset bounced off support levels at $112,000; Monday’s ETF exodus was tamer than Friday’s $812 million outflow.

Digital assets stealing market share

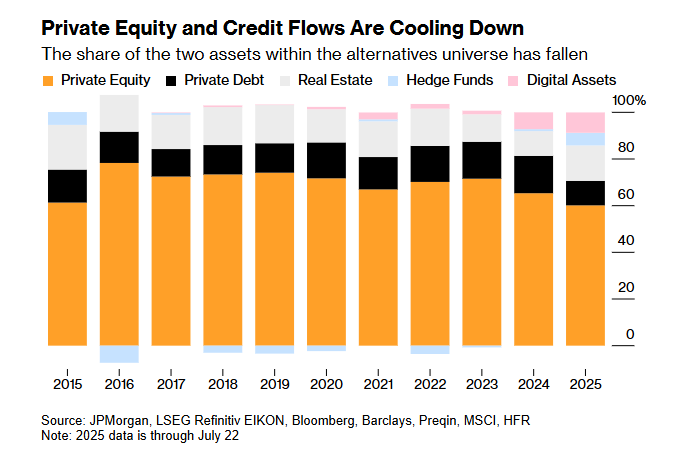

The bigger picture looks healthier for institutional digital asset products this year.

Bloomberg ETF expert Eric Balchunas reported on Monday that while the private asset boom is cooling off, digital assets and hedge funds have stolen market share this year.

“Within alternative asset classes, digital assets and hedge funds have been seeing an acceleration of inflows this year, in sharp contrast to the weak fundraising seen in private equity and private credit,” JPMorgan’s flows guru Nikolaos Panigirtzoglou told Bloomberg.

Capital inflows into digital assets are the fastest-growing segment of the alternatives market, the report noted, adding that the category had attracted $60 billion through July 22, following a record $85 billion last year.

ETFs a volatility killer

Balchunas also said on Monday that Bitcoin volatility has calmed since the launch of spot BTC ETFs.

The 90-day rolling volatility for the BlackRock IBIT fund is below 40 for the first time. It was over 60 when the Bitcoin ETFs launched in January 2024, he added.

Since the launch, there is much less volatility and “no vomit-inducing drawdowns,” he said last week before adding, “This has helped it [BTC] attract even bigger fish and gives it a fighting chance to be adopted as currency.”

Magazine: China mocks US crypto policies, Telegram’s new dark markets: Asia Express