What Happened In Crypto Today

Today in crypto, TradFi giants made 345 blockchain investments between 2020–2024, with G-SIBs leading 100+ deals across tokenization, custody and payments; Arkham Intelligence claims to have retroactively uncovered the biggest crypto hack in history. Meanwhile, Bitcoin ETFs saw $812 million in outflows, while Ether ETFs ended their longest inflow streak with $152 million in losses.

Citigroup, JP Morgan, Goldman Sachs lead TradFi’s blockchain charge: Ripple

Citigroup, JPMorgan Chase, Goldman Sachs and Japan’s SBI Group have emerged as the most active players in traditional finance backing blockchain startups, according to a new report by Ripple in partnership with CB Insights and the UK Centre for Blockchain Technologies.

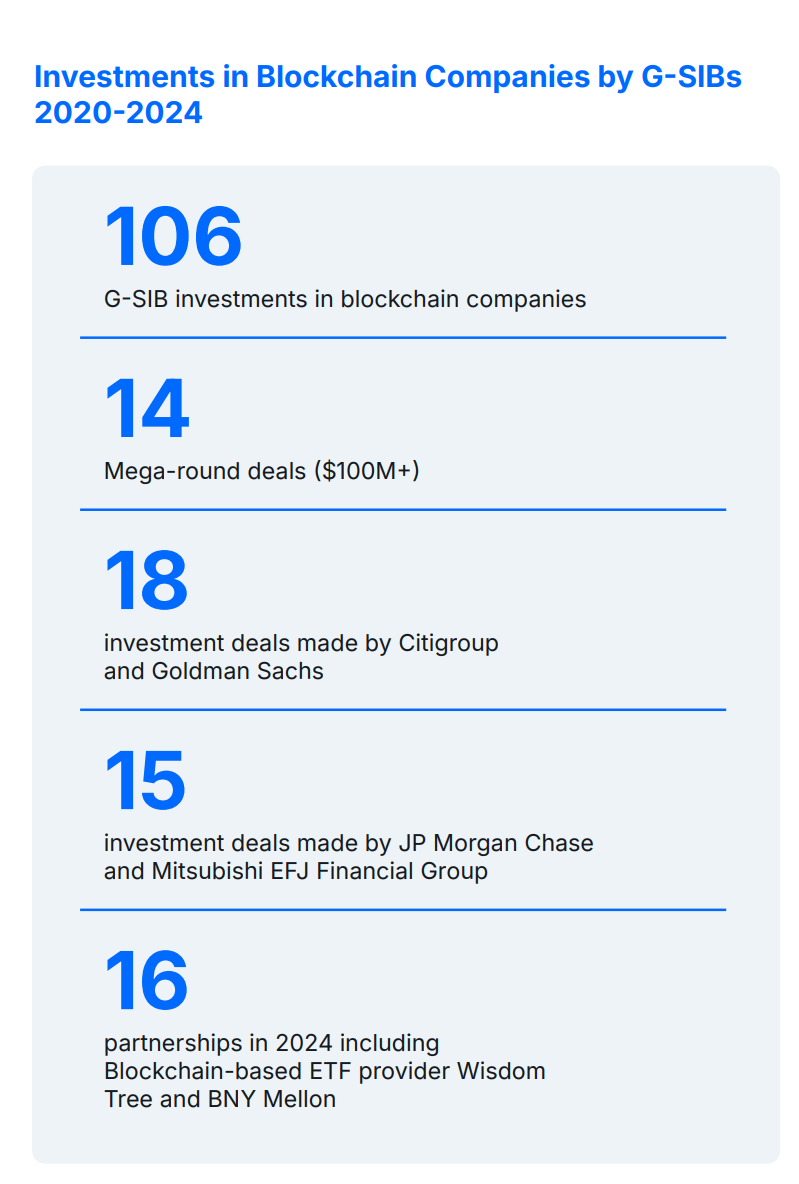

Between 2020 and 2024, global banks participated in 345 investments in blockchain companies, most of them in early-stage funding rounds, per the report. Citigroup and Goldman Sachs led the pack with 18 deals each, while JP Morgan and Mitsubishi UFJ followed closely with 15 investments.

Mega-rounds, deals worth $100 million or more, were a key focus. Banks contributed to 33 such rounds during the four-year window, pouring capital into firms focused on trading infrastructure, tokenization, custody, and payment solutions.

Notable examples include CloudWalk in Brazil, which raised over $750 million across two rounds backed by Banco Itaú and others. Likewise, Solaris in Germany secured over $100 million from SBI Group and later became a majority acquisition target.

Arkham Intelligence says it retroactively uncovered the biggest crypto heist in history

Blockchain analytics platform Arkham Intelligence claims to have retroactively discovered a $3.5 billion hack of a Chinese Bitcoin (BTC) mining pool dating back to 2020.

LuBian, a mining pool operator that emerged in May 2020, was hacked on December 28, 2020, and suffered the loss of 127,426 Bitcoin, valued at about $14.5 billion using current market prices, according to Arkham.

The mining pool was able to save 11,886 BTC by moving the funds to different addresses, which it still holds.

The blockchain intelligence platform said that the hack is suspected to have occurred through a brute-force attack, which revealed private keys that were generated by an algorithm and were insecure.

Spot Bitcoin ETFs see second-largest outflow, Ether ETFs end 20-day streak

Spot Bitcoin exchange-traded funds (ETFs) saw $812.25 million in net outflows on Friday, marking the second-largest single-day loss in the history of these products.

The drawdown erased a week of steady gains and pushed cumulative net inflows down to $54.18 billion. Total assets under management slid to $146.48 billion, representing 6.46% of Bitcoin’s (BTC) market capitalization, according to SoSoValue.

Fidelity’s FBTC led the exodus with $331.42 million in redemptions, followed by ARK Invest’s ARKB, which saw a substantial pullback of $327.93 million. Grayscale’s GBTC also lost $66.79 million. BlackRock’s IBIT posted a relatively minor loss of $2.58 million.

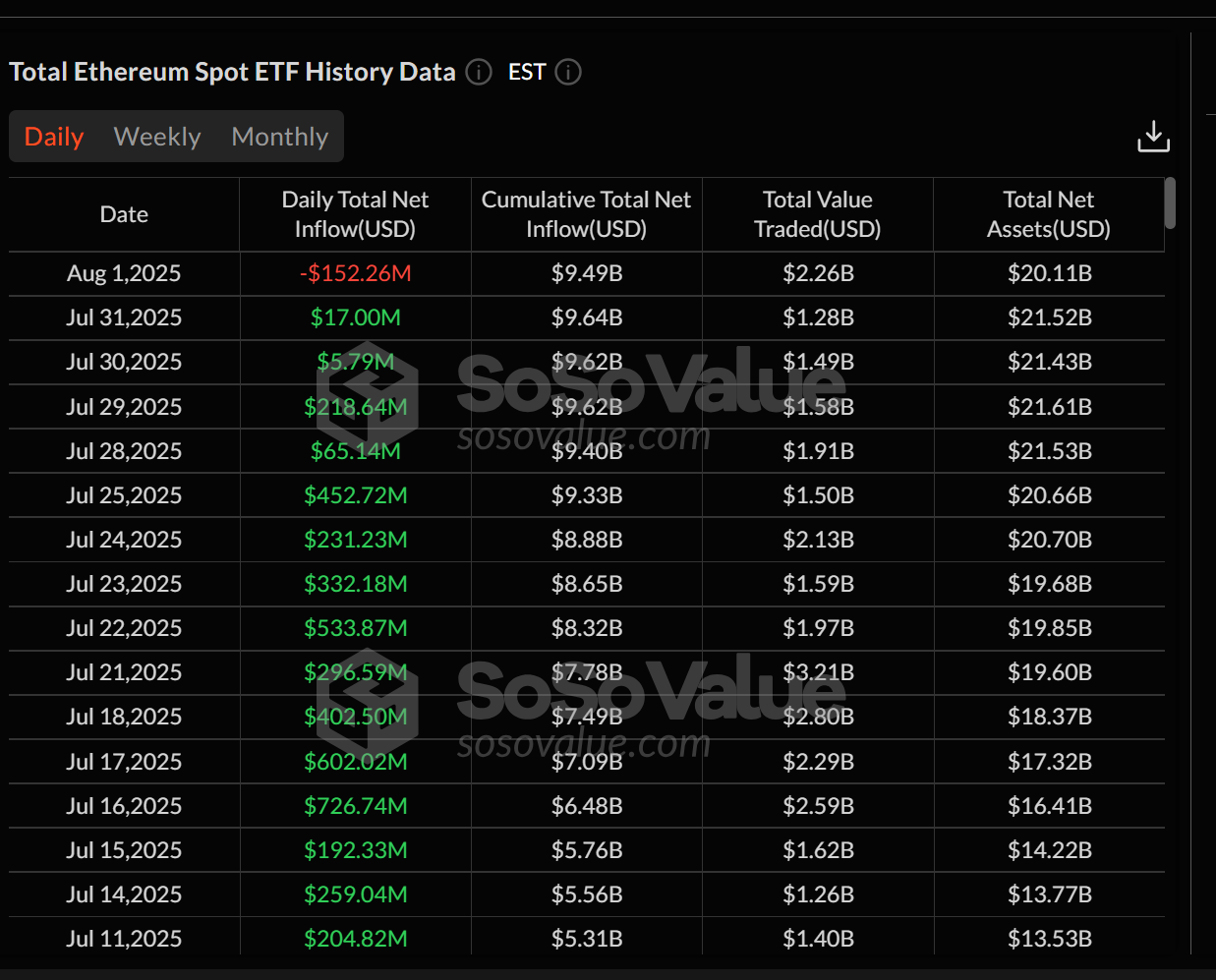

Meanwhile, Ether ETFs ended their longest inflow streak to date. After 20 consecutive trading days of net inflows, the sector recorded a $152.26 million outflow on Friday. Total assets under management now stand at $20.11 billion, or 4.70% of Ether’s (ETH) market cap.