DoubleZero Launches Mainnet Alternative to Public Internet for Blockchain

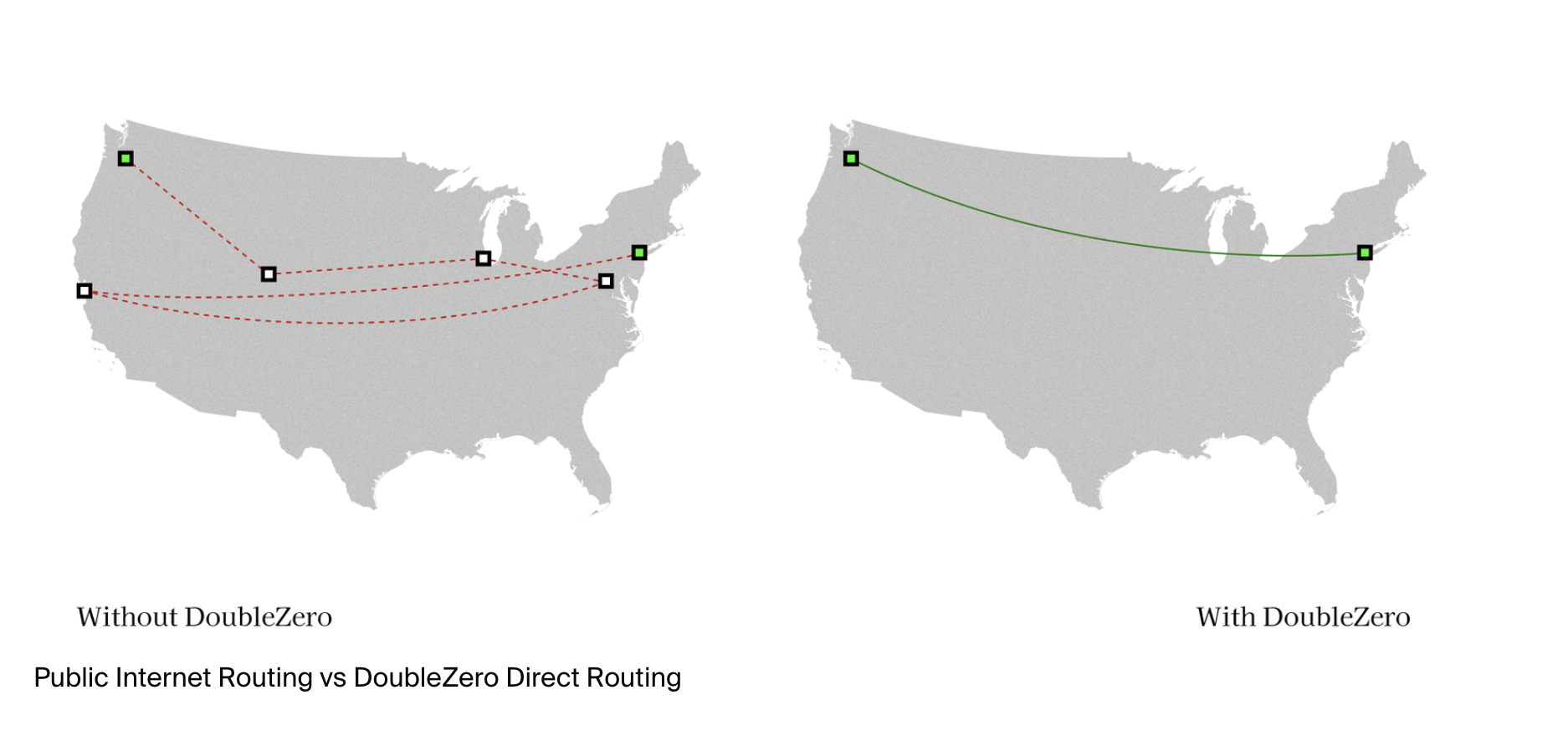

The DoubleZero protocol, a high-speed network of fiber-optic connections dedicated to serving high-throughput blockchain traffic, launched its mainnet-beta on Thursday, along with the public debut of the utility token that powers the network.

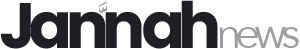

DoubleZero’s decentralized physical infrastructure network (DePIN) now hosts over 70 direct high-speed links between 25 geographic locations to route blockchain traffic directly between source and destination, reducing communication latency and maximizing speed.

The public internet is a bottleneck for crypto, DoubleZero founder Austin Federa told Cointelegraph in May, adding that the public internet was not designed for distributed consensus protocols because it is congested by general-purpose traffic, such as gaming and media streaming. Federa said:

« The downside of the public internet is that it was never built for high-performance systems. It was always built for this sort of relationship of one big server talking to one little server. »

DoubleZero’s launch of a high-speed communication network dedicated to blockchain and crypto networks signals that the industry has grown, shifting away from reliance on the public internet and its fundamental constraints on the distributed digital networks.

Related: SEC clears DePIN tokens as ‘fundamentally’ outside jurisdiction

SEC clarifies DePIN tokens fall outside its oversight

The US Securities and Exchange Commission (SEC) issued a no-action letter on Monday in response to DoubleZero’s proposed token launch, in a major victory for blockchain DePIN networks.

“The person who runs a node, provides storage, or shares bandwidth earns a reward. These tokens are neither shares of stock in a company nor promises of profits from the managerial efforts of others,” SEC commissioner Hester Peirce wrote.

“These projects allocate tokens as compensation for work performed or services rendered,” she continued, arguing that DePIN node runners function like owner-operators of businesses rather than investors in securities.

The SEC’s no-action letter cleared the way for the public launch of DoubleZero’s native token, following its closed sale to validators in April.

It also signals a seismic shift in the SEC’s previous position, categorizing most crypto tokens as securities and filing lawsuits against crypto firms launching novel products that did not necessarily fall under traditional asset labels.

The SEC under former chairman Gary Gensler’s leadership cost crypto firms at least $426 million in litigation costs, according to advocacy group The Blockchain Association.

Magazine: Most DePIN projects barely even use blockchain: True or false?