What Happened In Crypto Today

Today in crypto, Roman Storm’s trial is set to enter closing statements next week; 35 publicly traded companies now hold at least 1,000 BTC each, and a sudden drop in Bitcoin’s price has triggered $700 million in liquidations over the past 24 hours.

Roman Storm’s team expected to close case next week, developer may still testify

Defense attorneys representing Tornado Cash co-founder and developer Roman Storm will reportedly rest their case sometime next week, sending the matter to the jury.

According to reporting from Inner City Press on Friday, Judge Katherine Failla said she expected to hear closing statements from prosecutors and Storm’s legal team on Tuesday or Wednesday. The timeline gives the Tornado Cash co-founder roughly five days to present his defense in court.

Whether Storm intends to take the stand in his own defense was unclear as of Friday. Before his trial started, the Tornado Cash co-founder gave an interview in which he said he “may or may not” testify.

Friday’s court proceedings ended in the morning with testimony from an FBI special agent, who previously said Storm had control over some of the funds used with Tornado Cash. This marked the 10th day of Storm’s trial, in which he faces charges of money laundering, conspiracy to operate an unlicensed money transmitter and conspiracy to violate US sanctions.

Defense attorneys began presenting their case on Thursday, starting with testimony from Ethereum core developer Preston Van Loon. They reportedly said that as many as five witnesses could take the stand before they rested next week.

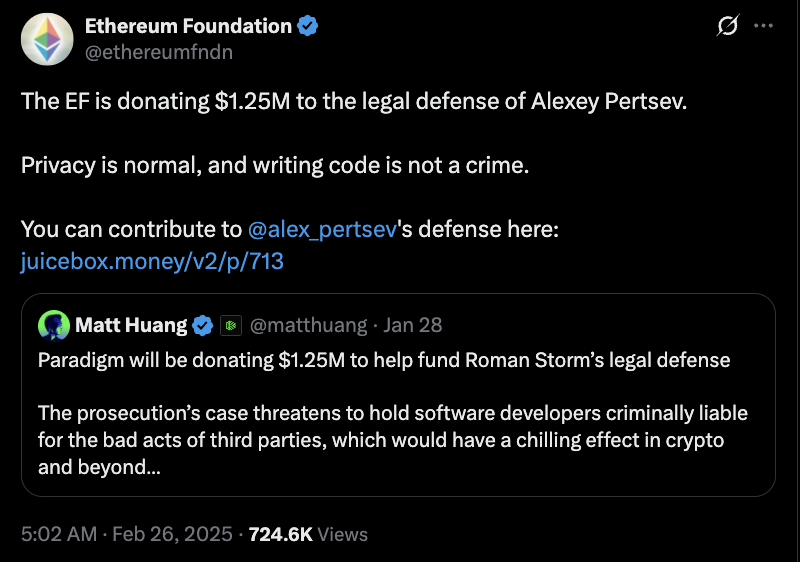

35 companies now hold at least 1,000 Bitcoin as corporate adoption booms

Corporate adoption of Bitcoin is accelerating, with 35 publicly traded companies now holding at least 1,000 BTC each, signaling growing institutional interest in the world’s largest cryptocurrency.

Demand for Bitcoin (BTC) is soaring among public companies four months after US President Donald Trump’s executive order outlined the creation of a federal Bitcoin reserve for the world’s largest economy.

According to Chris Kuiper, vice president of research at Fidelity Digital Assets, at least 35 public companies have now surpassed 1,000 BTC in holdings on their balance sheets, worth more than $116 billion at the time of writing, up from 24 companies at the end of Q1.

The growing Bitcoin-holding companies signal a “notable increase in Bitcoin exposure,” said Kuiper in a Thursday X post. “Bitcoin purchases became more widely distributed across public companies rather than concentrated among a few large buyers,” he added.

Fidelity’s data was published shortly after Bitcoin flipped Amazon’s $2.3 trillion market capitalization to become the world’s fifth-largest asset by total valuation, Cointelegraph reported on July 14.

Following the new wave of institutional buying, over 278 public entities are now holding Bitcoin, up from 124 just weeks ago, according to BitcoinTreasuries.NET.

The US leads all countries with 94 public entities holding Bitcoin, followed by Canada with 40 and the UK with 19 public BTC holding entities.

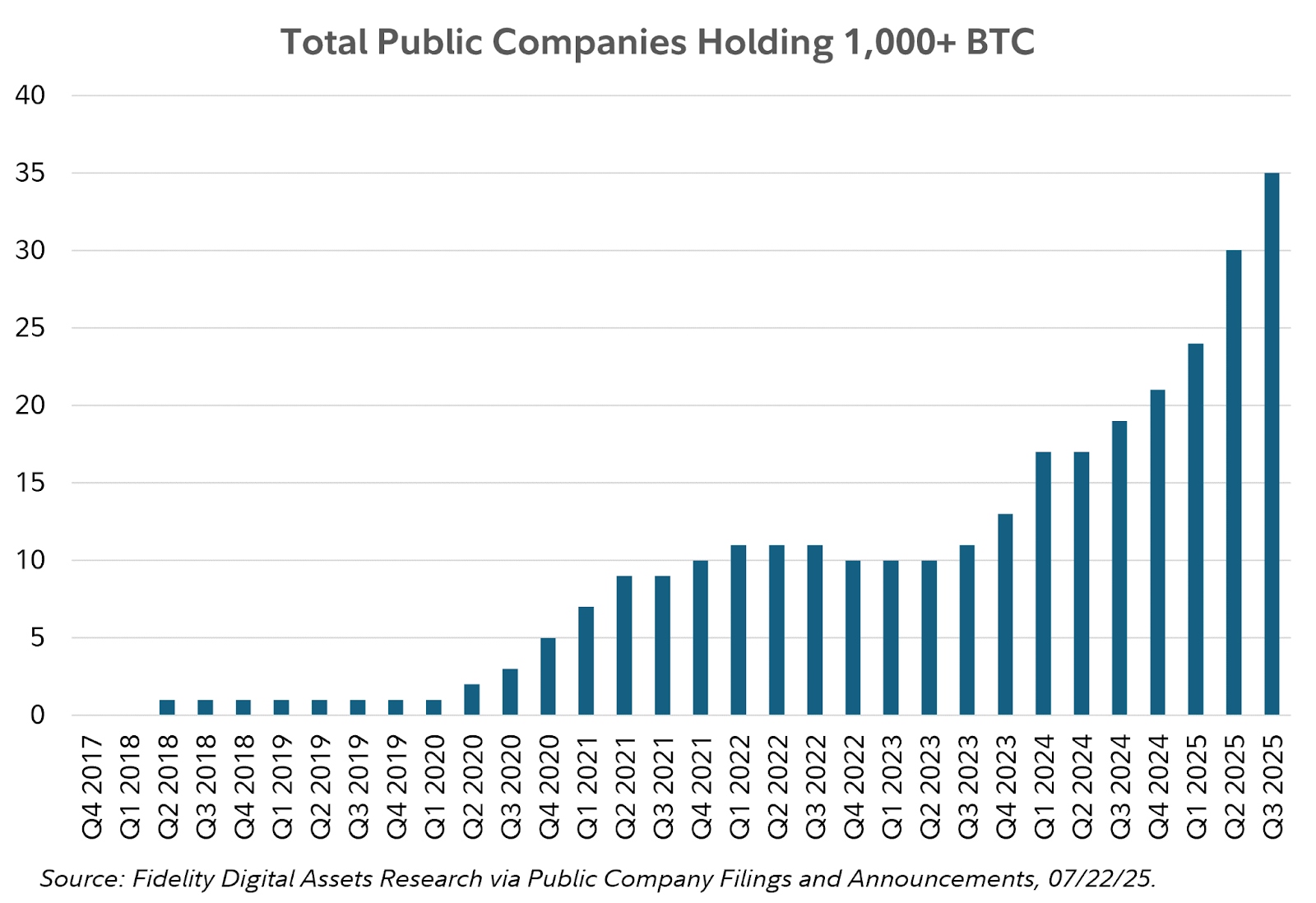

Bitcoin tumbles below $116,000 in bloodbath for crypto longs

More than half a billion in long positions were liquidated across the crypto market on Friday as the price of Bitcoin slipped below $116,000 amid a broader market tumble.

According to CoinGlass data, $585.86 million in long positions were liquidated, with Bitcoin (BTC) accounting for $140.06 million of that total as it dropped 2.63% to $115,356.

Ether (ETH) followed with $104.76 million in long liquidations, falling 1.33% to $3,598 over the same period.

The sudden market downturn led to the liquidation of 213,729 traders over the period, catching many off guard amid recent bullish sentiment. Across the board, a total of $731.93 million was wiped out of the market in short and long positions.